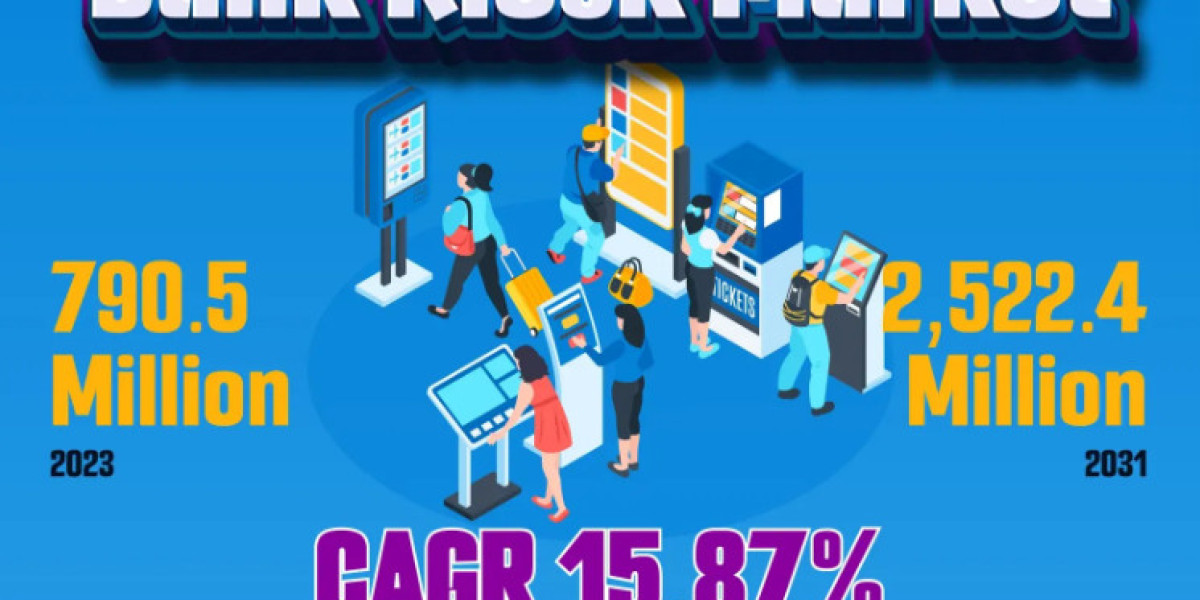

Kings Research™ presents this information in its report titled, Bank Kiosk Market Size, Share & Industry Analysis, By Type (Platform and Services), By Offering (Smart Contacts, Payment and Settlement, Product Traceability, Inventory Monitoring, Compliance Management, and Others), By End User, and Regional Analysis, 2024-2031"

Bank Kiosk Market size was valued at USD 790.5 million in 2023 and is projected to grow from USD 899.7 million in 2024 to USD 2,522.4 million by 2031, exhibiting a CAGR of 15.87% during the forecast period. Modernized payment processing platforms and growing demand for contactless transactions is driving the market.

Get Full Report Details Followed by TOC @ https://www.kingsresearch.com/bank-kiosks-market-265

March 2023 (Launch): Bank Muscat SAOG introduced self-service kiosks at key business hubs across Oman. This strategic move aligns with the bank’s customer-centric approach and ongoing efforts to enhance its Phygital network, improving customer access to services and reinforcing its digital transformation initiatives.

List of Key Companies in Bank Kiosk Market:

Bank Muscat SAOG, Diebold Nixdorf, Incorporated, Fiserv, Inc., GLORY LTD., Brink's Incorporated, Hitachi Payment Services Private Limited, VeriFone, Inc., Auriga Spa, KAL ATM Software GmbH, NCR Atleos Corporation

Europe is also making significant strides in the Bank Kiosk Market, with countries like the UK, Germany, and France leading the way. The region's focus on enhancing customer experience and embracing new technologies is contributing to the growth of the market. In particular, the adoption of biometric authentication and AI-powered bank kiosks is gaining momentum in Europe, as banks seek to improve security and offer more personalized services to their customers.

The Asia-Pacific region is emerging as a key market for bank kiosks, driven by the increasing penetration of digital banking and the rising demand for self-service solutions. Countries like China, India, and Japan are investing heavily in digital banking infrastructure to cater to the growing demand for banking services and improve the overall customer experience. The region's large and diverse customer base, coupled with the rapid pace of technological innovation, is expected to drive significant growth in the Bank Kiosk Market over the coming years.

The Bank Kiosk Market also faces challenges related to security and privacy. With the increasing reliance on digital banking solutions, concerns about data security and customer privacy are becoming more pronounced. Bank kiosks, which handle sensitive customer information, are particularly vulnerable to cyberattacks and data breaches. To address these concerns, banks must invest in robust security measures, such as encryption, biometric authentication, and regular security audits, to protect customer data and maintain trust.

Despite these challenges, the future of the Bank Kiosk Market looks promising, with continued advancements in technology and the increasing demand for self-service banking solutions driving growth. As the market evolves, banks will need to adopt a strategic approach to the deployment and management of bank kiosks, focusing on enhancing customer experience, optimizing costs, and ensuring security. The integration of AI, ML, and other advanced technologies is expected to play a crucial role in shaping the future of bank kiosks, enabling banks to offer more personalized and efficient services to their customers.

Key Drivers of Market Growth:

Increasing Demand for Digital Banking Services: As more customers opt for digital banking solutions, the demand for bank kiosks is on the rise. These kiosks offer a range of services, including account opening, cash deposits and withdrawals, bill payments, and loan applications, making them an integral part of the digital banking ecosystem. The convenience of 24/7 access to banking services through kiosks is particularly appealing to customers who prefer self-service options.

Cost-Effective Banking Solutions: Bank kiosks provide financial institutions with a cost-effective solution for delivering banking services. By reducing the need for physical branches and staff, banks can lower their operational costs while still offering a high level of service to customers. This is especially important in an era where banks are focused on optimizing their operations and improving profitability.

In the coming years, the Bank Kiosk Market is expected to witness several key trends that will shape its trajectory. One of the most significant trends is the increasing adoption of AI-powered kiosks, which are capable of delivering personalized customer experiences and automating complex tasks. These kiosks can analyze customer data in real-time to offer tailored services, such as personalized product recommendations and targeted marketing offers. Additionally, AI-powered kiosks can handle a wide range of transactions, from simple cash deposits to complex loan applications, without the need for human intervention.

In conclusion, the global Bank Kiosk Market is poised for remarkable growth in the coming years, driven by the rapid digitalization of the banking sector, evolving customer expectations, and the increasing need for efficient and cost-effective banking solutions. As banks and financial institutions continue to embrace digital transformation, the adoption of bank kiosks is expected to accelerate, offering a wide range of benefits, including enhanced customer experience, cost optimization, and improved operational efficiency. While the market faces several challenges, such as high initial investment costs and security concerns, the continued advancements in technology and the growing demand for self-service

Contact us:

Kings Research

Website: https://www.kingsresearch.com

E-mail: business@kingsresearch.com

Phone: (+1) 888 328 2189